Ad spending on CTV platforms continues with a projected increase of advancements and opportunities in the over-the-top (OTT) and connected TV (CTV) advertising space. As consumer viewing habits continue viewing streaming services ad dollars continue to migrate toward these channels as well.

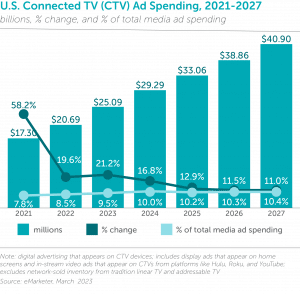

The industry built tools to better target streaming audiences and measure their viewing behaviors, with the goal of providing the most compelling ad opportunities for marketers looking to connect with valuable consumers. Making up 10% of all digital ad spending, CTV ad spending is expected to reach $29.29b in 2024.1

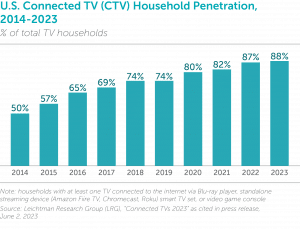

Connected TV penetration in U.S. households continues to grow, as more households acquire internet-connected devices to watch content.2

CTV’s ability to merge the often separated performance and brand marketing worlds is redefining the digital advertising space as we once knew it. Given the immense ad opportunities that CTV/OTT offers—including precise, digital-like measurability and a high-quality viewing environment and the valuable audiences it draws in—and the significant investment in these channels, advertisers and brands are increasingly focused on proving the effectiveness of their OTT campaigns.

Through next-generation CTV ad platforms, marketers can now understand the CTV exposure-to-outcome impact of their ads. Given the large investment in this media channel, attribution—the process of assigning credit for conversions to various marketing touchpoints along the customers’ journey—has become a must-have for growth and performance marketers. This information is critical to creating more effective ad campaigns and boosting revenue. In measuring conversions following ad exposure for CTV, it’s important to understand which exposure caused the conversion to take place. For example, if a person sees an ad for Jersey Mike’s Subs on CTV and grabs their phone to do a quick search for the nearest location, then clicks on the link and places an order. This behavior will be attributed to Google, while in fact the search and the sale were 100% inspired by the TV ad. This faulty attribution dynamic has played out for years, resulting in hundreds of billions of dollars in valuation being hijacked by last-click digital companies.

While some attribution models use basic analytics data, they only provide a template and often fail to account for important steps in the marketing funnel. While last-touch attribution has long been the “go-to” measurement method, marketers now need to explore different attribution methodologies, given the increasingly fragmented media space and evolving consumer journey. The digital ad space needs to advance our understanding of single-touch measurement models, as they assign 100% of conversion credit to only one marketing touchpoint and often focus on only the first or last interactions, and adapt more sophisticated methods of analysis for campaigns. By leveraging different attribution methodologies, marketers can gain more in-depth insights regarding ad effectiveness to drive future marketing decisions.

It’s important to understand that attribution is a journey and the consumer journey is ever-changing. Today, a person can be exposed to a brand’s ad across numerous platforms and devices before purchasing. In fact, in the modern age of marketing across platforms, devices, and channels, the typical retail consumer requires an average of 56 touchpoints before making a purchase.3 It is important to assign proper credit to each touchpoint so that marketers can determine where their budget should be spent.

Our award-winning proprietary Performance CTV platform matches and tracks OTT/CTV impressions across premium inventory sources to real-world events, including site visits, store location visits, subscriptions, app installs, form-fills, purchases, revenue, and more to provide a more granular look at the consumer journey. We know, deterministically, at the household level, when someone is exposed to an ad and then takes action—whether it be digitally or physically. With our platform, advertisers can analyze exactly what’s driving desired results among consumers using multiple attribution methodologies.

Our Performance CTV platform takes attribution a step further, measuring every single touch prior to a conversion. Powered by innovative technology, the platform allows users to toggle freely between four different attribution methodologies in real-time to see exactly which touchpoints are driving the most leads, sales, installs, or visits among consumers. Advertisers have the ability to shuffle the distribution of credit according to the following attribution methodologies:

First Touch: All conversion credit assigned to the first variables that the converter was exposed to.

Last Touch: All conversion credit assigned to the last variables that the converter was exposed to.

Time Decay: Credit weighted more heavily across variables that the converter was exposed to as said exposures approach conversion (aka credit increases as time to conversion decreases).

Linear: Credit evenly dispersed across all variables that the converter was exposed to.

Our Performance CTV platform is the one-stop-shop for advertisers and agencies looking to transform data into actionable items that can be leveraged and improved upon in the future. By measuring and assigning credit to different variables in your campaign, our platform determines the true impact of each of them on any KPI—providing a new standard in tracking, transparency, and results via comprehensive attribution insights. Our platform then uses these insights to inform its media buying with a bidder that moves the budget toward the highest-performing campaign variables—lowering CPAs, maximizing ROAS, and making a tangible impact on a brand’s bottom line. Expanding your attribution methodologies will not only help refine your budget strategy but will have a lasting impact on your current and future ad campaigns.

Sources:

CTV viewership has exploded. To take advantage of the channel’s surging audience, e-commerce and retail brands are making CTV a key part of their advertising strategy. CTV allows brands to apply an audience-first, data-driven approach to TV similar to other digital channels. However, as ad strategies continue to become more CTV-reliant, brands need greater clarity on performance and ROI. Our proprietary performance CTV platform, Flip, provides that clarity to e-commerce and retail advertisers.

Flip connects mobile location data with CTV ad impressions to help brands granularly understand campaign performance, attribution, and Return on Ad Spend (ROAS). Flip helps advertisers and agencies accurately and granularly measure CTV campaign effectiveness. The platform provides an easy-to-use dashboard that shows CTV buyers exactly which campaigns are working across which devices, publishers, demographics, and more – all in real time. Using proprietary software, Flip can tie ad impressions to app installs, cart amounts, and site visits. The platform can even match a CTV impression to an in-store visit when that device shows up in a physical store, uniquely tying digital impressions to physical actions. With its full-funnel attribution capabilities, Flip traces every CTV impression to a conversion and sheds light on ROAS as CTV investments grow.

“With Flip, we’re able to connect real-world sales events to CTV impressions to let retailers know, definitively, that someone was exposed to their CTV ad, and then visited their site or made a purchase. We’ve set our sights on elevating CTV to a fully accountable performance media channel — driving real-world results for our clients by allowing them to activate against their data or third-party data to maximize return on ad spend. Flip has answered the call for a new benchmark for measuring campaign success, even on platforms that don’t have a lot of transparent reporting, and we’re thrilled to extend it to e-commerce and retail brands.”

– Head of Activation at Agency Partner

Flip is the cornerstone of our full CTV/OTT offering, helping digital ad buyers optimize targeting, tracking, and campaign management across multiple platforms and devices. Now, e-commerce and retail clients can leverage and unlock real-time insights, measure the true impact of campaigns and optimize to drive results. With Flip, e-commerce and retail marketers can:

“As the industry aims to keep pace with consumer demand for personalized experiences in an economic environment where every dollar counts, measurement and performance have become critical metrics for retail advertisers. We’re ecstatic to extend Flip’s capabilities in the retail and e-commerce sector and remain committed to providing a holistic solution by which advertisers can unlock and optimize real-time insights, measure campaign effectiveness, and drive valuable results.”

– Matt Sotebeer, Chief Strategy Officer at Digital Remedy

To learn more about Flip, visit www.digitalremedy.com/flip or speak to one of our team members to book a demo and see the platform in action.

The CTV/OTT space presents many advantages for B2B marketers, including clear targets, ideal buyer profiles, and precise targeting strategies. However, B2B marketers are feeling increased pressure to prove the value of CTV/OTT in reaching their target audience and without the right digital attribution, it can be tough to prove success and maximize return on ad spending (ROAS).

TJ Sullivan, SVP of Sales at Digital Remedy was recently featured in MarketingProfs, where he discussed digital attribution in the OTT/CTV space. Specifically, TJ outlined five ways to succeed with CTV/OTT, improve ROAS, and boost your bottom line:

Multi-touch attribution for CTV/OTT gives you the ability to see the customer journey beyond just first- and last-touch—which is especially crucial for B2B marketers looking to understand the full customer journey.

CTV/OTT metrics let you dive into the details to understand which tactics moved the needle with the right people in the right way. Factoring in incrementality lets you see the real picture by taking all attributed conversions and filtering out ones that the campaign didn’t directly drive.

Good B2B marketers know how to recognize buy signals—those actions and behaviors that indicate a prospect is ready to buy. Being able to recognize those “telling” signals and match them to the strategy—optimizing creative, targeting, and placement to drive those signals—is a key advantage in CTV/OTT advertising when it’s done right.

The beauty of CTV is that it enables real-time optimization of ad buys in comparison with Linear, which means you are able to move your budget toward the publishers, creatives, dayparts, audiences, and geographies that are working to drive the most action to fully maximize your spend.

When you combine multi-touch attribution with real-time performance metrics, it creates a powerful platform to fully optimize targeting and content delivery.

While it may be relatively new to some marketers, multi-touch attribution must become a top priority, as it allows you to not only identify the specific touchpoints throughout the consumer journey that triggered the desired action, but also leverage valuable performance insights to optimize future campaigns. With the Flip OTT performance platform, Digital Remedy is making it accessible and simple for brands and marketers at all levels to win in the OTT/CTV space. To learn how you can leverage alternative attribution methodologies within our award-winning CTV platform, visit www.digitalremedy.com/flip.

Check out TJ’s full insights on MarketingProfs and be sure to follow Digital Remedy on LinkedIn and Twitter for the latest updates.

2021, and marketing budgets have returned to normal. This is in part due to the launch and expansion of new ad-supported streaming services. CTV ad spend pricing has increased throughout the last year, which has in reaction, increased overall spend. CTV ad revenue growth will decrease slightly, following the huge spike, however, CTV ad spend will gain share of overall digital ad spending through 2025, passing 10% by 2024. The future of CTV ad spending is bright—more than doubling in 2025 to surpass $30b.1

2021, and marketing budgets have returned to normal. This is in part due to the launch and expansion of new ad-supported streaming services. CTV ad spend pricing has increased throughout the last year, which has in reaction, increased overall spend. CTV ad revenue growth will decrease slightly, following the huge spike, however, CTV ad spend will gain share of overall digital ad spending through 2025, passing 10% by 2024. The future of CTV ad spending is bright—more than doubling in 2025 to surpass $30b.1CTV viewership increased across all generations this year compared to 2020. Gen Z and Millennial users will continue to increase through 2025. YouTube is the number one OTT platform in the U.S. when it comes to penetration among OTT video service users, with market share of 95.5%. YouTube CTV viewers grew almost 63% last year and surpassed the 50% threshold for the share of viewers who watched YouTube content on CTVs.2 In addition, YouTube was found to be the number two streaming service when comparing total hours spent watching content on CTVs in the U.S.

Ad fraud detection and measurement will be extremely important because the demand for inventory will outweigh the high-quality supply. Most CTV inventory is bought and sold through private markets, which prevents fraudsters’ ability to fake ad impressions. However, the demand and price of CTV inventory is increasing which results in two scenarios:

1. Advertisers are attracted by the lower pricing in the open market

2. Fraudsters are attracted by the high demand and premium they can charge on fake inventory

Last year, Pixalate, a firm that monitors ad fraud, estimated that more than 20% of programmatic OTT and CTV ad impressions were served as invalid traffic.3 Given the significantly complex ad environment, fueled by ever-changing technologies, it’s nearly impossible to eliminate fraud completely. However, there are certain steps advertisers can take to protect their brand and their budget—ensuring exposure to fraud is minimal and ad spend is directed where it’s intended. As CTV fraud increases in scope and sophistication, it’s critical for marketers to work with trusted partners that have the experience, knowledge, scale, and ability to identify and block new threats as they emerge. Check out our recent report to learn more.

Models for marketing attribution have been used for many decades, but as the needs of customers have changed and companies have undergone digital transformations, marketing attribution has evolved. The roots of marketing mix models (MMMs) can be traced back to the 1950s. As campaigns become more complex in today’s multichannel world, accurate campaign measurement and attribution has become a major struggle for advertisers and agencies, and, unfortunately, many lack the time and resources to do so. Not to mention, a list of long-standing measurement and attribution problems that plague marketers, including a lack of standardized metrics and definitions across traditional and digital TV and video, issues with basic data accuracy and infrastructure, a lack of organizational alignment, and the difficulty of understanding and validating attribution models.

The truth is, attribution is evolving and advertisers need to reevaluate the methodologies they are leveraging to ensure they are assigning credit accurately. While innovations in attribution have brought the focus away from video completion rate (VCR) and toward return on ad spend (ROAS) and cost per action (CPA) metrics, those goals are merely scratching the surface of CTV measurement. Many performance marketers are looking to optimize their CTV campaign performance, but don’t know where to start. The ability to track a customer journey and measure ad impact is incredibly powerful, especially for today’s agile marketers that are laser-focused on managing and optimizing their spend with flexibility in a changing environment. Moving forward, advertisers who expand their attribution methodologies will help refine their budget strategy and ensure a lasting impact on future ad campaigns.

than that from external sources. Until opting out, these are your customers, and they have chosen to share their contact information and purchasing choices with your business. Third-party data regulations are preventing tracking, companies are needing to shift their efforts. 42% of U.S. data users will increase spending on the use of first-party data. This shift was forced due to changing regulations on third-party cookies that are being collected. With consumers increasing concern about how and what data is being collected, companies are going to need to shift how they obtain data. The highest-performing companies are taking note and starting to utilize first-party data, which will not only be a new buzzword but the foundation and future of the marketing world.

than that from external sources. Until opting out, these are your customers, and they have chosen to share their contact information and purchasing choices with your business. Third-party data regulations are preventing tracking, companies are needing to shift their efforts. 42% of U.S. data users will increase spending on the use of first-party data. This shift was forced due to changing regulations on third-party cookies that are being collected. With consumers increasing concern about how and what data is being collected, companies are going to need to shift how they obtain data. The highest-performing companies are taking note and starting to utilize first-party data, which will not only be a new buzzword but the foundation and future of the marketing world.While hindsight might be 20/20, forward thinking will allow brands to stay competitive and be prepared for the inevitable shifts in consumer preferences, media consumption, and more. One thing is certain, working with a partner that specializes in diversified digital ad strategies and offers innovative technology can be a lifesaver in today’s dynamic environment. To discover how Digital Remedy helps advertisers and agencies of all sizes navigate the ever-changing digital ad space, visit www.digitalremedy.com.

Digital Remedy recently hosted a Tech-Talk webinar “To Last Touch & Beyond: Measuring Performance CTV” through eMarketer, explaining why marketers should move beyond last-touch attribution methodology, focusing instead on more nuanced ways to drive bottom-line results via OTT/CTV—and why working with an experienced media partner is crucial in today’s complex ad space. If you missed it, here’s a recap:

As the duopoly becomes increasingly saturated, improvements in measurement have proved that lower-funnel media can have branding impacts, and upper-funnel media can have performance impacts—and this is most evident in the CTV space. CTV’s ability to merge the often separated performance and brand marketing worlds is redefining the digital ad space.

In the modern age of marketing, the typical consumer requires an average of 56 touchpoints before making a purchase. Very rarely does someone convert after a single ad exposure. Marketers need to take every touchpoint (across devices and platforms) into consideration and assign credit accordingly. While last-touch attribution has long been the status quo of the ad space, marketers can discover more insights by expanding their attribution methodology.

While innovations in attribution have brought the focus away from VCR and toward ROAS and CPA metrics, those goals are merely scratching the surface of CTV measurement. Many marketers are looking to optimize their CTV campaign performance, but don’t know where to start. Working with the right media partner will allow you to uncover valuable—previously unattainable—campaign performance insights.

You can watch the full presentation on-demand or view the slides. Interested in learning how you can start driving bottom-line results? Schedule a custom Flip demo to see our award-winning CTV performance platform in action.

For the latest industry trends and insights—including more on how to leverage multiple attribution methodologies and incrementality—check out our blog and sign up to receive our monthly Trends newsletter delivered right to your inbox.