Jul 5, 2023

The OTT/CTV Space is Booming Ad spending on CTV platforms continues with a projected increase of advancements and opportunities in the over-the-top (OTT) and connected TV (CTV) advertising space. As consumer viewing habits continue viewing streaming services ad dollars continue to migrate toward these channels as well. The industry built tools to better target…

Ad spending on CTV platforms continues with a projected increase of advancements and opportunities in the over-the-top (OTT) and connected TV (CTV) advertising space. As consumer viewing habits continue viewing streaming services ad dollars continue to migrate toward these channels as well.

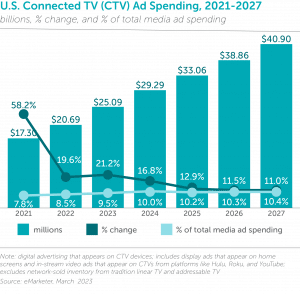

The industry built tools to better target streaming audiences and measure their viewing behaviors, with the goal of providing the most compelling ad opportunities for marketers looking to connect with valuable consumers. Making up 10% of all digital ad spending, CTV ad spending is expected to reach $29.29b in 2024.1

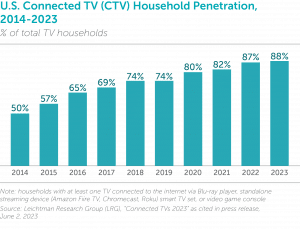

Connected TV penetration in U.S. households continues to grow, as more households acquire internet-connected devices to watch content.2

CTV’s ability to merge the often separated performance and brand marketing worlds is redefining the digital advertising space as we once knew it. Given the immense ad opportunities that CTV/OTT offers—including precise, digital-like measurability and a high-quality viewing environment and the valuable audiences it draws in—and the significant investment in these channels, advertisers and brands are increasingly focused on proving the effectiveness of their OTT campaigns.

Through next-generation CTV ad platforms, marketers can now understand the CTV exposure-to-outcome impact of their ads. Given the large investment in this media channel, attribution—the process of assigning credit for conversions to various marketing touchpoints along the customers’ journey—has become a must-have for growth and performance marketers. This information is critical to creating more effective ad campaigns and boosting revenue. In measuring conversions following ad exposure for CTV, it’s important to understand which exposure caused the conversion to take place. For example, if a person sees an ad for Jersey Mike’s Subs on CTV and grabs their phone to do a quick search for the nearest location, then clicks on the link and places an order. This behavior will be attributed to Google, while in fact the search and the sale were 100% inspired by the TV ad. This faulty attribution dynamic has played out for years, resulting in hundreds of billions of dollars in valuation being hijacked by last-click digital companies.

While some attribution models use basic analytics data, they only provide a template and often fail to account for important steps in the marketing funnel. While last-touch attribution has long been the “go-to” measurement method, marketers now need to explore different attribution methodologies, given the increasingly fragmented media space and evolving consumer journey. The digital ad space needs to advance our understanding of single-touch measurement models, as they assign 100% of conversion credit to only one marketing touchpoint and often focus on only the first or last interactions, and adapt more sophisticated methods of analysis for campaigns. By leveraging different attribution methodologies, marketers can gain more in-depth insights regarding ad effectiveness to drive future marketing decisions.

It’s important to understand that attribution is a journey and the consumer journey is ever-changing. Today, a person can be exposed to a brand’s ad across numerous platforms and devices before purchasing. In fact, in the modern age of marketing across platforms, devices, and channels, the typical retail consumer requires an average of 56 touchpoints before making a purchase.3 It is important to assign proper credit to each touchpoint so that marketers can determine where their budget should be spent.

Our award-winning proprietary Performance CTV platform matches and tracks OTT/CTV impressions across premium inventory sources to real-world events, including site visits, store location visits, subscriptions, app installs, form-fills, purchases, revenue, and more to provide a more granular look at the consumer journey. We know, deterministically, at the household level, when someone is exposed to an ad and then takes action—whether it be digitally or physically. With our platform, advertisers can analyze exactly what’s driving desired results among consumers using multiple attribution methodologies.

Our Performance CTV platform takes attribution a step further, measuring every single touch prior to a conversion. Powered by innovative technology, the platform allows users to toggle freely between four different attribution methodologies in real-time to see exactly which touchpoints are driving the most leads, sales, installs, or visits among consumers. Advertisers have the ability to shuffle the distribution of credit according to the following attribution methodologies:

First Touch: All conversion credit assigned to the first variables that the converter was exposed to.

Last Touch: All conversion credit assigned to the last variables that the converter was exposed to.

Time Decay: Credit weighted more heavily across variables that the converter was exposed to as said exposures approach conversion (aka credit increases as time to conversion decreases).

Linear: Credit evenly dispersed across all variables that the converter was exposed to.

Our Performance CTV platform is the one-stop-shop for advertisers and agencies looking to transform data into actionable items that can be leveraged and improved upon in the future. By measuring and assigning credit to different variables in your campaign, our platform determines the true impact of each of them on any KPI—providing a new standard in tracking, transparency, and results via comprehensive attribution insights. Our platform then uses these insights to inform its media buying with a bidder that moves the budget toward the highest-performing campaign variables—lowering CPAs, maximizing ROAS, and making a tangible impact on a brand’s bottom line. Expanding your attribution methodologies will not only help refine your budget strategy but will have a lasting impact on your current and future ad campaigns.

Sources:

Related Posts

In the constantly evolving digital advertising landscape, agility and flexibility are paramount. As agencies and advertisers look to maximize.

When COVID-19 upended the world in early 2020, the ripple effects were swift and far-reaching across every industry, and.

As artificial intelligence continues to dominate headlines and industry conversations, confusion still lingers—especially around the relationship between artificial intelligence.